Ma Cpa License Lookup - A. Find and contact institutions that offer accounting programs for details. All certified public accountants must meet the educational criteria of the Public Accounting Act of the State Council on Public Accounting. It includes a degree consisting of at least 150 semester hours of college and a diploma.

B. Make sure your program is approved by the State Board of Accountancy. All programs must be accredited by an agency approved by the US Department of Education. The State Board of Public Accountancy approves institutions accredited by the Commission on Colleges of the Southern Association of Colleges and Schools and offering at least a bachelor's degree.

Ma Cpa License Lookup

In. Enroll in courses that can earn college credit. A bachelor's degree and the following courses must be included in your 150 semester hours of college:

Texas State Board Of Public Accountancy

After meeting the educational standards of the State Board of Public Accountancy, you can apply to take the unified CPA exam.

A. Complete the State Board of Public Accountancy (TSBPA) Notice of Intent. This will help the Board determine whether you can pass the single CPA exam based on your credit history and good credentials. You must also send documents including:

In. Then complete the online application to meet the criteria. At the same time, you must also pay $15 to the TSBPA for each part of the Unified CPA exam you wish to take.

D. After receiving notification of approval from TSBPA. So you have 90 days to take the part of the exam you want to take

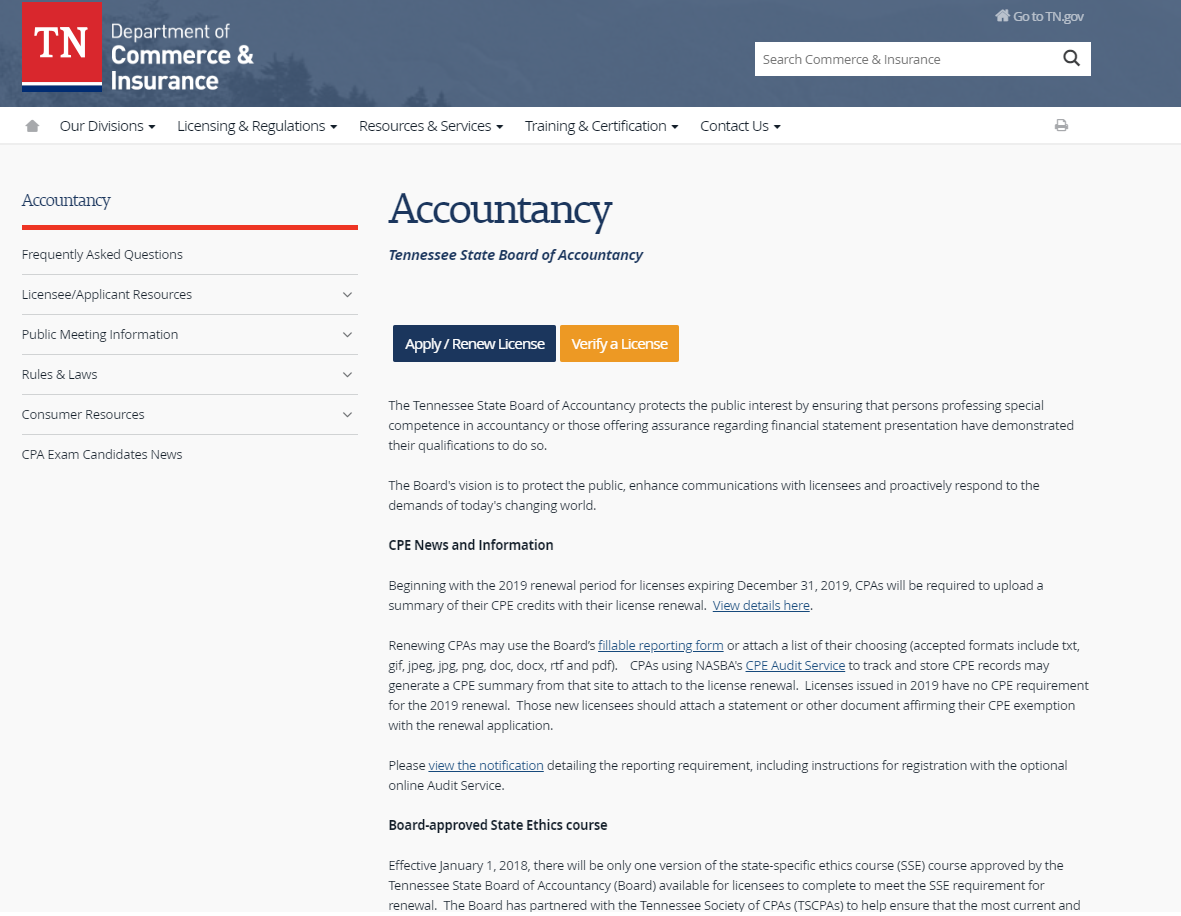

Verify A License

Mr. To schedule an exam, visit the Prometric Testing Center website

In addition, to obtain a license, you must have full experience with the State Board of Accountancy.

So, if you've passed the exam and gained work experience, it's time to get your CPA license. Double check that you've done everything and everything is set up. Here is a list of CPA license requirements:

If you have a license from another country, but you want to work as a CPA in Serbia, you need to meet all the requirements for a CPA certificate holder in Serbia.

Helen Heyn Riverway

To maintain your CPA certification in , you must meet your state's Continuing Professional Education (CPE) requirements.

Karin is new to content writing. She is studying biomedical engineering at NPUA and previously studied marketing at LPFA. He also participates in various engineering projects and competitions such as USVC 21 – Venture Cup. She started writing content a year ago and since then has written about 100 articles for various websites. Karine was engaged in various volunteer activities, business meetings, etc. According to Karine, all of her volunteer work has helped her improve her communication, teamwork, and problem-solving skills, which helps her write content today because she knows what people want to hear and what information they need. This is just the beginning and for this girl everything is just a statistic. is an ideal choice if you are planning to become a CPA and obtain an accounting license. Now is the time to familiarize yourself with the laws and regulations of becoming a CPA, as the CPA license is one of the most valuable in the entire business world. To find a CPA license, you can simply scroll down the page and find answers to frequently asked questions or use the form above.

To become licensed as an accountant, you'll need a bachelor's degree or higher from an accredited college or university, 150 semester hours, including 30 hours of accounting with courses in auditing, financial accounting, management, and tax accounting.

In addition, the candidate must have at least one year of full-time or equivalent experience providing some form of service or instruction, obtainable through employment in government, business, academia, or community practice, requiring the use of accounting, management consulting, financial , tax or consulting skills.

University Of Massachusetts Amherst Double Diploma Frame In Galleria

In addition, 12 months with an average of at least 20 working days per month during which the applicant worked full-time for 1,500 hours per year or more.

Applicants may obtain experience only after completing 120 undergraduate hours and earning a bachelor's degree in accounting or an equivalent degree.

If someone works part-time for more than a year and less than four years and gains 2,000 hours of experience, that means they have gained experience equivalent to one year of full-time work.

To certify individuals who have passed the four sections of the single CPA exam, the AICPA Comprehensive Course must be completed with a minimum score of 90%.

Pdf) A Chemically Stabilized Sulfur Cathode For Lean Electrolyte Lithium Sulfur Batteries

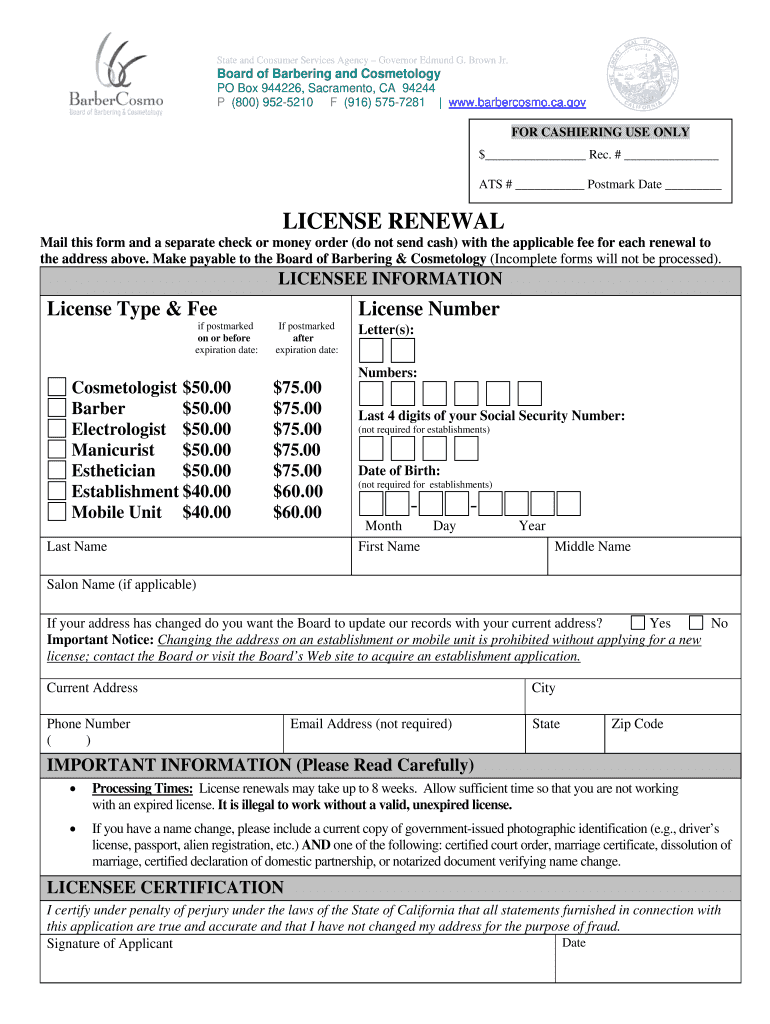

Submit the complete application package and prescribed fees to the Division of Financial and Professional Regulation, ATTN: Division of Professional Regulation, P.O. Box 7007, Springfield, IL 62791. If you are looking for CPA license search results, you can find them here.

If you already hold an equivalent state license, you can apply directly to the Department of Financial and Professional Regulation for a license and do not need to be approved by the Examining Board.

You can check with the State Board of Accountancy where the person was licensed to confirm that the CPA has a valid license. Alternatively, you can use the NASBA CPA Verify tool.

The easiest way to verify your CPA license is with our IL CPA License Finder Tool. To use the CPA license search, you will need to enter either a license number or an individual's name and/or company name.

How To Verify Your Prc License Record And Confirm Identities Of Registered Professionals Online

The cost to take all four parts of the CPA exam is $743, plus an initial fee of $120. The transfer fee depends on the number of chapters you transfer.

Lily has six years of experience creating content for SEO. She has written numerous articles for various websites and companies on various topics. She can help with ghostwriting, blogging, guest posting, technical writing, and more. Lily writes SEO content for businesses looking to improve their Google search rankings. He regularly writes articles on business licensing, digital marketing, cyber security, fashion, psychology and more. Over the years of writing content for various websites, Lily has developed a unique writing style. She also worked as an SEO expert. Lily has received very high marks for the websites she has worked with. She uses a combination of different optimization tools and content in her work because she understands that well-optimized content is KING. Finally, you can meet the Board of Accountancy's experience criteria after completing all four parts of the Single CPA exam.

Has a two-tier system, which means you must have a CPA license and a CPA license. Double check that you meet all the requirements.

If you want to keep your accounting license, you must meet state continuing professional education (CPE) standards.

How To Become A Cpa Without An Accounting Degree

In most cases, the CPA certificate is just an endorsement. This ensures that you have passed the CPA exam and meet the necessary passing criteria. On the other hand, after meeting all the standards set by the Board of Accountancy, you will receive a CPA license.

Karin is new to content writing. She is studying biomedical engineering at NPUA and previously studied marketing at LPFA. He also participates in various engineering projects and competitions such as USVC 21 – Venture Cup. She started writing content a year ago and since then has written about 100 articles for various websites. Karine was engaged in various volunteer activities, business meetings, etc. According to Karine, all of her volunteer work has helped her improve her communication, teamwork, and problem-solving skills, which helps her write content today because she knows what people want to hear and what information they need. This is just the beginning and for this girl everything is just a statistic. Are you ready to start your career as a state board licensed CPA, but not sure where to start? Policies vary by state, but here's a quick rundown of all the steps you need to take before becoming a CPA in .

To become a CPA (Certified Public Accountant), you must first obtain a bachelor's degree and then complete 150 credit hours. In addition to becoming a CPA, you must complete your studies and pass the CPA exam. You can become a certified public accountant by passing the CPA exam with state boards of accounting. Being a CPA is hard, but rewarding.

To be licensed and appear on the CPA license list, you must earn a bachelor's degree or higher from an accredited college or university.

Massachusetts Institute Of Technology Tassel Edition Diploma Frame In Newport

When you earn credit for your courses at a regionally approved institution that offers a bachelor's degree or higher, either by correspondence or online

Cpa license lookup ohio, cpa license lookup california, cpa illinois license lookup, cpa license number lookup, arizona cpa license lookup, cpa license lookup texas, nj cpa license lookup, nc cpa license lookup, pa cpa license lookup, cpa license lookup, cpa license lookup ny, maryland cpa license lookup

0 Comments